What countries and businesses are welcome?

We're following the general notion of onboarding every jurisdiction and business that is not a red flag for our regulator, Lithuanian Central Bank. We always try to give the businesses a chance if they are willing to explain their business model in proper details and provide us with good proof of that they are who they say they are. There are, of course, reasonable boundaries - no illegal businesses will be onboarded, and no business that requires a license to operate shall be onboarded without such a license. You can see the map of who we consider as great and ok regions to work with on our main page.

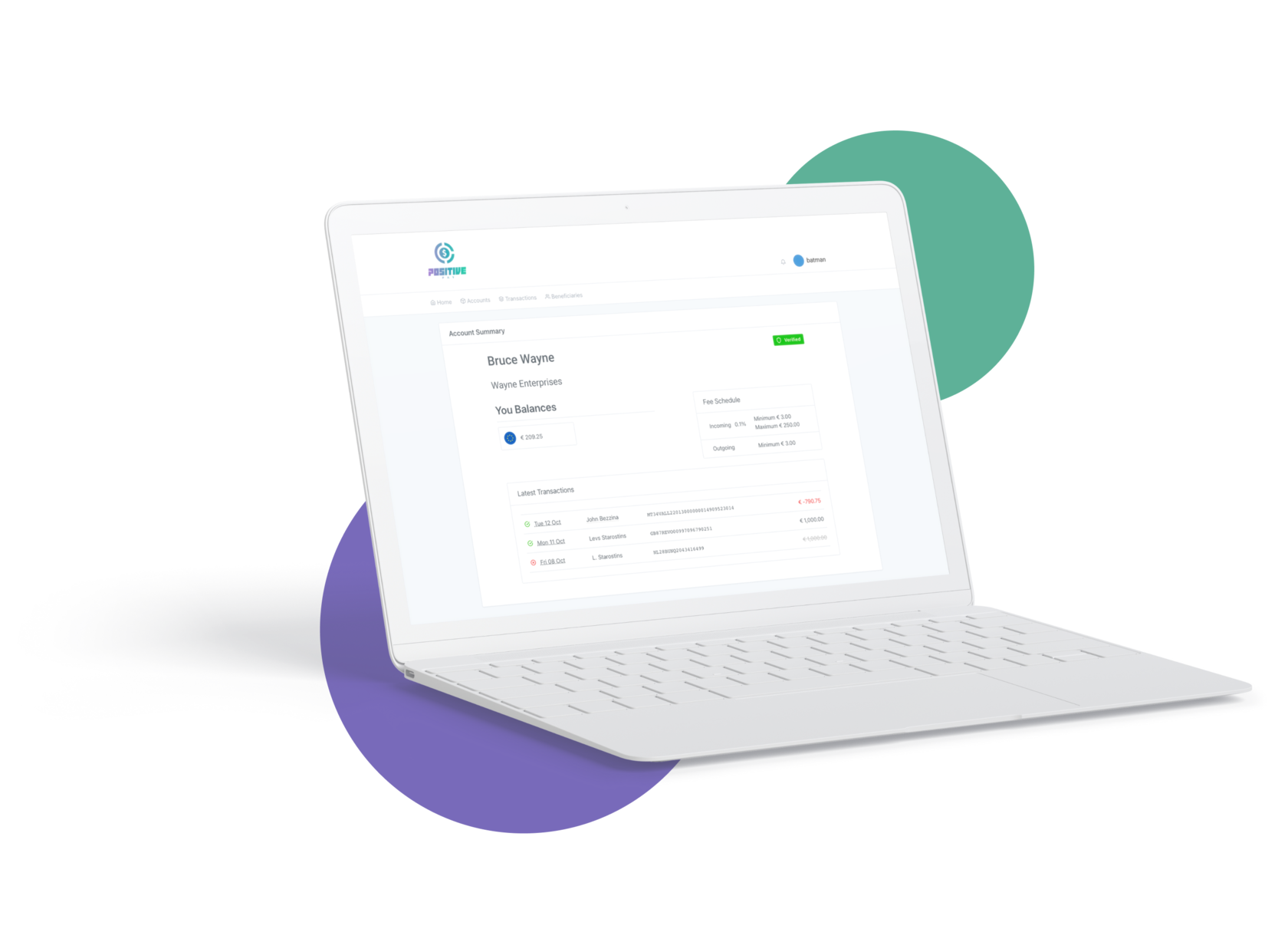

What is the pricing of PositivePay?

We decided to review each case on a separate basis and provide our clients with the best possible fee structure based on all aspects of their business - risk of their jurisdiction and industry, relatedness to crypto, beneficiary owners backgrounds and so forth, so that we can provide the low risk clients with the lowest fees possible.

How does your service work? Is my money safe?

Your money, once received by us, is kept on the safest of safest of accounts - the Lithuanian Central Bank accounts, meaning that your money is as safe as a whole developed country in Europe. In exchange for your money, we provide you with an equal amount of e-money, which you can move between PositivePay accounts, exchange between different currencies or transfer to bank accounts outside PositivePay, in which case we will send the money from Lithuanian Bank to the banking details you indicate. We don't touch your money, loan it, use it or play with it in any manner, so there's no risk of losing it.

Do you charge the 0.5% annual fee that European Central Bank charges everyone?

Yes, however we do this only on our bigger clients, who hold more than 10,000.00 Euro on their account as a daily average within a calendar month. We decided to carry this fee for small enterprises so that they have a better chance of success. For those of our clients who don't know - we are a member of the European Payments Council with our partnership Swift BIC code and as such come under the rates stipulated by the ECB via the Central Bank of Lithuania we need to pay 0.5% per annum on the amount on all the accounts. It's calculated on a daily basis and is charged monthly. You can read more about this requirement here.

How do you manage the additional capital requirement by the Lithuanian Bank?

We need to comply with the Lithuanian Bank requirements, but, again, we decided to relieve the smaller clients, and start applying this only to those who hold 250,000.00 Euro or more. As such, any Payment User who holds a balance of more than 249,999.99 Euro will be charged a deposit of 3% of the total balance which will be reviewed based on the outstanding balance once a month. Funds will be reviewed to return to client if average outstanding balance decreased at the end of every calendar quarter. You can read more about this requirement here.

Who can I pay from my Positive Pay accounts?

You can pay to individuals and business into bank accounts anywhere in the world in 138 different currencies.

Who can pay into my accounts?

You can receive funds in 38 currencies from almost all countries. If there's any doubt on receiving a certain payment - just ask our friendly Support.

Do you work with crypto?

This is a sensitive question, as crypto currencies are potentially an instrument for illicit activities. As such, we can provide tailored solutions to the business who can explain the need for such operations, the source of income in crypto, and provide the necessary paperwork and proof of crypto transactions. We will be monitoring these businesses and their transactions closely to prevent any wrongdoing.

Do you offer services to payment institutions?

Yes, we do. We provide both operational accounts and safeguarding accounts for clients funds. That being said, we only provide this to licensed businesses with respectable regulators backing their licenses.

Is there anything else I need to know before onboarding?

Before onboarding, you will go through pre-approval, which will let you know if your business has a good chance of passing through our in-depth KYC procedure. If all is fine and you decide to commit, we will provide you with our terms and conditions and further instructions to set up your account.